Data is at the core of making smarter business decisions, and without relevant, up-to-date, and accurate financial data business leaders are unable to align their strategy correctly with the financial position of the business.

Gathering this data is just the beginning as business leaders must also understand how to translate the numbers into usable insights for decision-making.

Understanding past performance

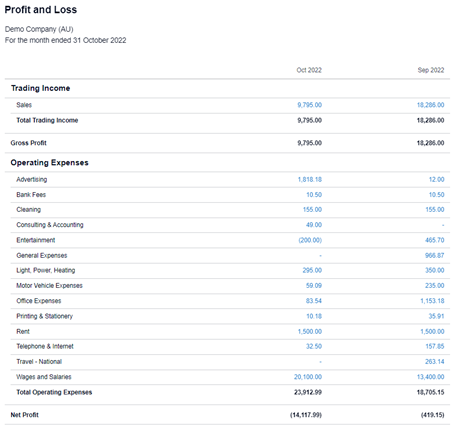

The Profit & Loss report shows the revenues and expenses for any set period and totals these to show the overall profits or losses produced for that period. This report is often considered one of the most important financial statements as it represents the operating results of the business.

Taking a closer look at the Profit & Loss statement can reveal the relationship between income and expenses and provide a picture of what happened over the reporting period. Comparing to prior reporting periods can reveal opportunities to achieve better efficiencies by deciding what you would like to see less of and what you would like to increase.

Analysing your current Profit & Loss statement to past statements can also reveal if your business is growing, stagnant, or declining, allowing you to make decisions based on these statements. Comparing statements can also reveal any correlations between changes in your business to the bottom line, and if something isn’t working you can quickly revert before further damage is done. Recognising these problems early allows you to come up with new growth strategies and can ensure that you are always heading in the right direction.

Net profit vs cash-flow

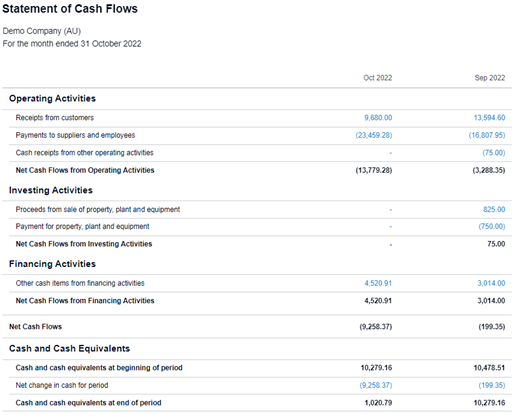

Businesses often struggle with ‘not seeing’ the money that they make, and watching it appear to go out faster than it comes in despite making an overall profit. Cash moves differently from the net profit numbers on paper and this is where the Statement of Cash Flows comes in.

The Statement of Cash Flows sheds light on the timing of incoming and outgoing cash and provides you with an overall picture of what’s happening in your bank account. It measures how well a business generates cash to pay its debt obligations and fund its operating expenses, and reports on operating, investing, and financing activities to help you determine which areas are performing well and which areas could use improvement.

A negative net cash flow from operating activities may still occur despite the business recording an accounting profit for the same period. Often negative cash flow can indicate poor timing of income and expenses, for example, your bills may be due and payable before a customer pays an invoice. Poor cash flow may be a bottleneck to your business and undermine how your business looks to third parties including banks when you go to finance that next piece of equipment or apply for a business loan to support the next phase of growth.

Employee wages are a great example of where your business may have to outlay cash to pay wages before work is completed, or cash is received for the work they complete. Reviewing your Statement of Cash Flows regularly may reveal opportunities for improvement including:

- Set stricter invoice payment terms for customers

- Negotiate payment terms with suppliers if applicable

- Reduce or eliminate certain operating expenses

- Consider what can be done to increase sales for your industry

- Review margins to ensure costs are being covered

- Chase up any old debtors and consider if a debt collector needs to be involved

- Can old inventory or equipment be sold to increase short-term cash

- Consider if an overdraft account or business loan could help

- Consider upcoming tax bills to ensure you won’t be caught out

Forecasting the future

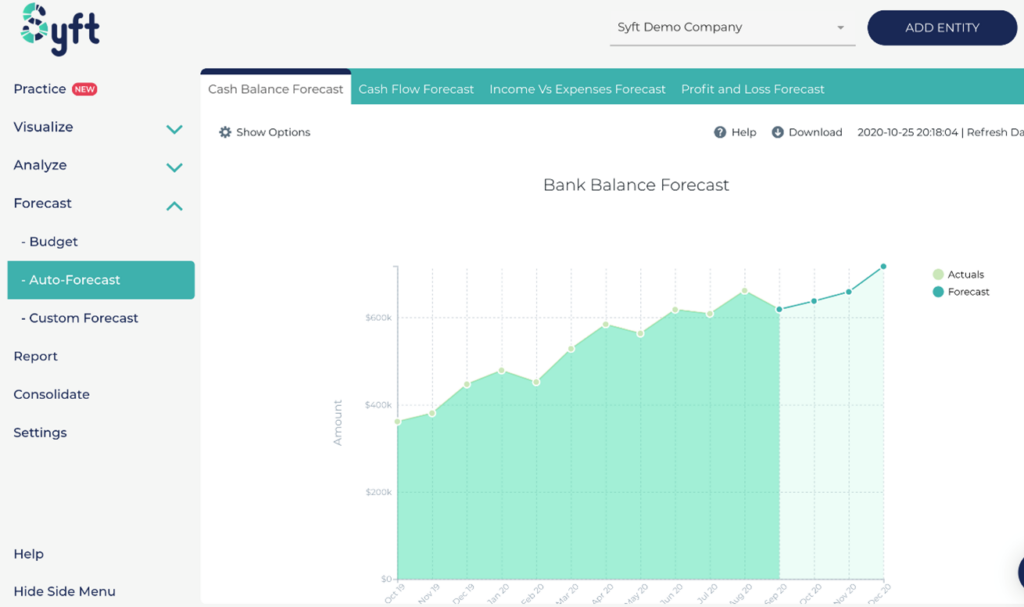

Making decisions for your business would be exponentially easier if you could look into the future and know how much cash you would have available at a certain point. Forecasting may never be 100% accurate and is heavily based on the inputs given, but it provides a great foundation to understand all of your options before making a critical business decision.

Whether it’s preparing cash reserves for anticipated cash shortages or preparing for seasonal changes within your industry, forecasting the future can help you to make critical decisions before it’s too late.

Syft Analytics provides a great forecasting tool that can assist with forecasts for projected cash balances, cash flow, and profit & loss for between 1 to 12 months into the future.